Fintech

Fintech is the word which is a simple combination of two words ‘fin’ which means finance and ‘tech’ means technology. It is used for the technological changes in the financial service sector and financial products for the customers.The use of financial technology are in the areas or fields such as banking companies, insurance companies, investment firms, and all the sector which are related to finance. Technology always has their roles in the finance industry but fintech totally changes the working style as well as it combines the financial business with the internet, mobile phones, laptops and other technical devices.

To understand better use e-money wallet which is connected from bank accounts for direct payment. It can be easily linked through the Smartphone. Fintech has expand their boundaries which also include the consumer oriented products including financial literacy, advice, education retail management, bowworing, money transfers, payments etc.

To understand better use e-money wallet which is connected from bank accounts for direct payment. It can be easily linked through the Smartphone. Fintech has expand their boundaries which also include the consumer oriented products including financial literacy, advice, education retail management, bowworing, money transfers, payments etc.Bitcoin is also in the form of fintech and it uses in cryptocurrencies. There is still a loop in the traditional methods of fianancial working industry with market capitalisation.

There are number of services which comes under financial services money transfer, check deposit, credit application, investment management are for name a few.

Benefits Of FinTech

- Convenient for users:-Fintech products are basically work of the online platform so it is very rapid and easier form.

- Option of choice:-In the fintech products there is a option of varied options of products and Services.

- Efficient format:-As there is no need of investment in physical format so the deals which are provided are in cheaper and efficient rates.

- Personalisation of products:-In fintech there is a huge option of saving a lot of information regarding the customer data which ensures more personalised product for better experience.

Pros Of FinTech

- Finech reduces the operational costs of the company and make the company working more efficient and effective.

- In the fintech there is a huge option of flexibility as it provides various alternatives which also provide personalisation.

- Fintech help the companies in effective as well as transparent manner which leads to better communication in the work.

Cons Of FinTech

- All the data of the user is provide online which can be easily transferred or used with the third parties. This can be use for the identity theft.

- Fintech is mainly used by the big firms in effectiveness.

- It structures a multi level structure which focuses on the areas to lower the cost of the operations.

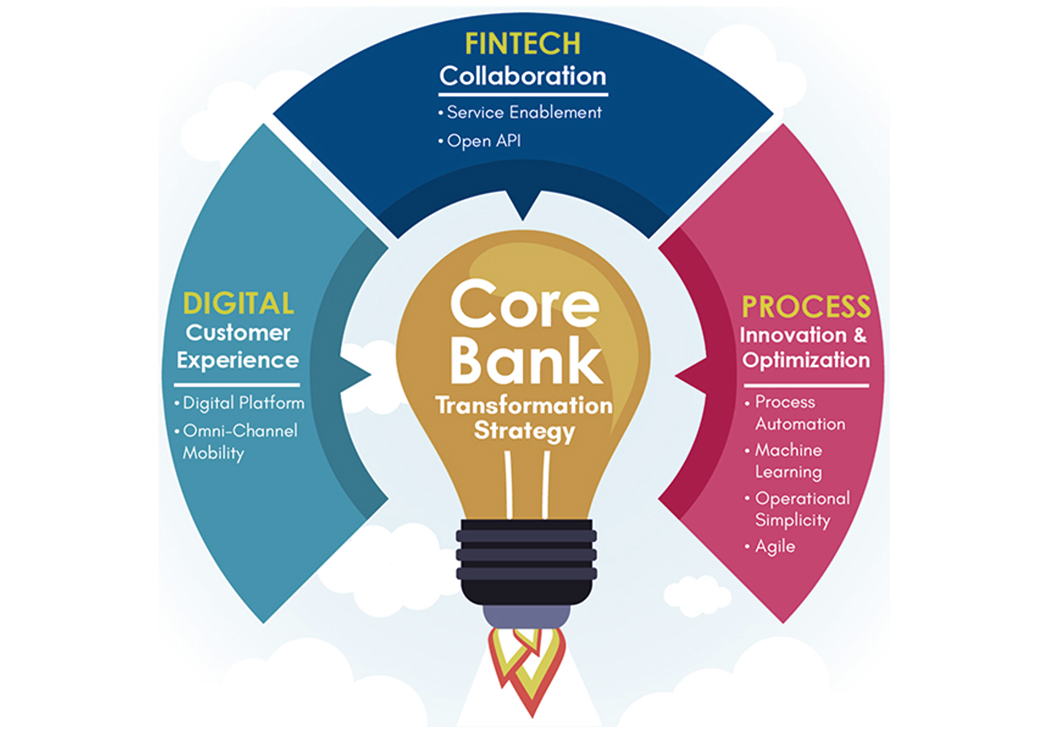

Core Banking:-

Transformation is the part of every working place or in industry. There is a huge difference between the operation of the banking industry and the need of customer for their work. Fintech have provided the solution for all the problems in the banking and technical solutions. There are so many technologies in the new transformation in blockchain, big data as well as in artificial intelligence.

How fintech helps in banking sectors:-

Fintech helps in improving the performance and improving the opportunities in the sectors. It also improvises the customer relationship as well as performance or customer retention. Choosing HFM solutions for the core banking is the best option. It not only provide the varied services but also helps in solving the finance related problems. They are providing all the financial related services and consumer banking.

Mobile Banking:-

Now a day’s people are very busy because of their working. There is a huge change in the banking and financial sector. Smart phones become an undivided part of regulatory and transformation in the working sector.In the mobile banking the main advantages are to provide multiple platform banking. Efficiently launch banking experiences.

Fintech helps in crafting the mobile applications more feasible, efficient and secure for using.

HFM solutions provide entire mobile banking solutions and digital experience which helps in secure and convenient transactions.

Internet Banking:-

Internet changes the world and working of the companies in the today’s scenario. Working in any sector cannot be imagined without the internet banking system. Banking and financial technology implies in customer services in 24x7 time period.HFM solutions provides engaging online services such as all the financial as well as non-financial transaction services.

Doorstep Banking:-

Every time it is not possible for the customers to reach the bank for their needs. This is a huge problem for senior citizens also. In this style of banking services facilities like pickup of cash, demand drafts and paper work etc done in the comfort place of the consumer without any hectic schedules. All the work in the door step banking cannot be done with the fintech and internet though.HFM Solutions provide entire Banking solutions for Doorstep Banking.

Cheque Truncation:-

Cheque truncation system is the system of cheque clearance which is introduced by the “Reserve Bank Of India” for the banking and financial services. In this, image of cheque with MICR code and other credentials used instead of physical or any payee cheque.

Enterprise Reporting:-

As per the description of the government authorities to creating the needed reports enterprise reporting is the part which helps in financial reporting and services. There are mandatory report making in these financial institutions.